Antonia Stratford

Contact our Head of Public Affairs for further information.

A fairer deal for a modern economy

Bricks-and-mortar businesses – on high streets across the country, including London’s West End - carry an unfair share of the business-rates burden, holding back the UK economy. The 2025 Autumn Budget confirmed that from 1 April 2026, further significant rate increases will fall on England’s physical businesses, with retail, hospitality and leisure facing the greatest pressure.

HOLBA’s solution, a Hybrid Business Rate, rebalances an outdated system to match the changes in our modern economy. By ensuring digital operators contribute fairly, we ease the burden on businesses occupying physical sites, protecting jobs, strengthening high streets and driving national growth.

Bricks-and-mortar businesses continue to shoulder a disproportionate share of taxation, despite the Government's promise of permanently lower rates for the retail, hospitality, and leisure sectors.

Today, retail and hospitality businesses make up an estimated 9% of the economy, yet contribute an estimated 34% of all business rates. Meanwhile, the fast-growing digital economy, contributing an estimated 20% of GVA to the economy, does not contribute its fair share to local Government services paying an estimated 7% - 9% of total business rates.

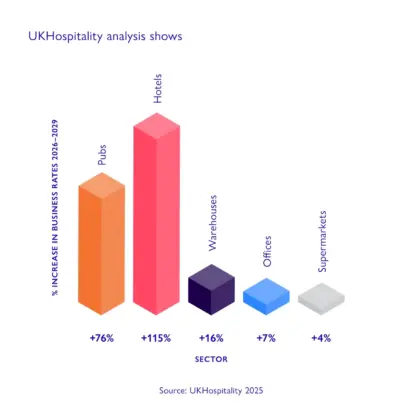

Increases in business rates penalises businesses occupying physical premises.

The experience economy (pubs, hotels, restaurants, theatres, cafés, retailers and galleries) faces the greatest pressure. Rateable value increases are driving substantial business cost rises, which threaten the UK economy.

Without reform, investment, jobs, and cultural vibrancy are at risk.

Rising costs for businesses with physical premises push up consumer bills and inflation, suppressing spending both online and on high streets, with knock-on effects for local communities and the wider economy.

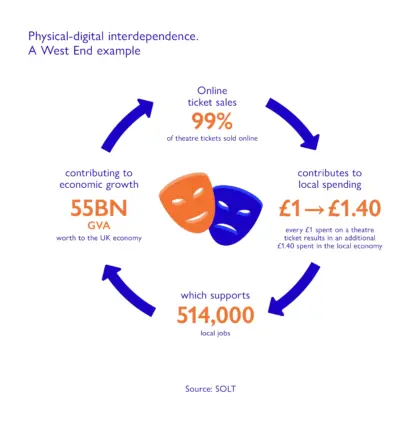

Online spending and local experiences are interdependent. For example, in the West End, 99% of theatre tickets are purchased online, yet every £1 spent generates £1.40 in the local economy, supporting shops, restaurants, and other businesses.

The West End alone contributes £55bn a year to the UK economy, but some businesses face rate rises of over 100% from April 2026.

Without Real Rates Reform, our high streets, local jobs, and national growth are under threat.

This British hotel chain in central London, offers smart, space-efficient rooms at a more accessible price point than most competitors.

The latest Budget delivers a significant blow to the hotel chain and wider hospitality sector. From April 2026, the chain’s business rates bill will rise by an estimated 100% across its 12 London hotels — a £4 million increase spread over four years. This means almost 10% of all revenues will go directly to business rates, a stark jump from the typical 2% benchmark. These escalating costs are entirely out of step with revenue growth over the past six years.

To cope, the chain is reviewing staffing levels across its hotels and leaving vacancies unfilled — decisions that risk service standards and jobs in a sector already under intense pressure.

In the heart of the West End, this world-class attraction delivers unforgettable experiences for families and corporate groups alike, attracting 100,000s people per year to the area.

Under the new higher rate multiplier due to come into effect in April, as well as the removal of the rates relief scheme, the business will see its annual rates bill increase by over a third, pushing its total tax burden past £2 million.

As a result, the business has already began to review further UK investment in the short term and focus on international markets for growth and expansion. For the wider economy, that means fewer jobs, less innovation, and a weaker experience economy — putting the ambitions of the London Growth Plan at risk.

To keep London’s cultural attractions thriving, tax policy must strike a balance: raising revenue without stifling the very industries that make the city a global leader.

This West End theatre hosts a resident production and delivers over 400 performances each year. The venue employs a mix of permanent staff, front-of-house teams, and technical crews, and, like many of the UK’s historic theatres, requires constant investment in maintenance, safety, building improvement, and accessibility.

Under the Government's business rate proposals, from April, the theatre faces a projected 30% rise in its business rates bill over the next three years.

With operating costs for utilities, staffing, and insurance rising at twice the rate of revenue, there is little capacity to absorb additional fixed costs. Ticket prices cannot simply be increased without undermining audience accessibility and demand.

The additional business rate burden will inevitably divert essential funds from maintenance and modernisation, reducing flexibility for wider investment priorities, including accessibility enhancements and environmental upgrades that support the theatre’s long-term sustainability.

As costs rise and margins tighten, the risk grows that heritage venues will become less attractive to producers and audiences alike, threatening a cornerstone of the UK’s cultural economy and visitor appeal. For every £1 spent on a theatre ticket, an additional £1.40 is spent locally in restaurants, bars, shops, and transport.

Increased business rates therefore risk weakening the wider ecosystem that depends on the West End’s success.

Business rates were introduced in 1990, when digital operators barely existed. Despite reliefs, revaluations, and promises to permanently lower rates for retail, hospitality, and leisure (Autumn 2025 Budget), the system remains outdated and unfair. Government aims to “capture the online giants,” yet current reforms continue to place heavier burdens on the physical businesses that power high streets and local economies, undermining stated policy objectives.

HOLBA’s Hybrid Business Rate solution evolves the current system to match the changes in the economy in the 35 years since business rates were introduced in 1990.

Our Hybrid Business Rate Solution allows property-light digital businesses, now around 20% of the UK economy, to pay their fair share to the cost of funding vital local government services.

This meets the Government’s key objectives of supporting the high street, levelling the playing field between online and high street activities and creating a modern, sustainable and transparent system.

Follow our campaign calling for a fair business rates for the modern economy.

Follow us on LinkedIn for real-time updates on the Business Rates campaign.